Sell or Lease IPv4: The Break-Even Math Explained

Discover when it's smarter to sell or lease IPv4 addresses. Real numbers, ROI models, and market data to guide your next IP monetization move.

Artem Kohanevich

Co-Founder & CEO at IPbnb

Jan 21, 2026

Last updated

Table of Contents

AI Summary

Sitting on unused IPv4? Here's how to decide: sell or lease.

Cogent earns $15M+ per quarter from leasing – not selling. The math is clear.

Key takeaways:

• Sale prices dropped 40-50% YoY. /16 blocks now under $20/IP

• Lease rates stable at $0.40-0.50/IP/month with 80% utilization

• At 80% occupancy, leasing beats selling in ~5.5 years

• RIR transfer rules (12-24 months) make leasing more liquid

• BYOIP leasing cuts AWS IPv4 fees ($43/year per IP)

Sell → need instant capital or exiting IPv4 market

Lease → want recurring income + keep ownership + stay flexible

In a soft sale market, leasing often wins.

When Cogent Communications, one of the world's largest network providers, began monetizing its surplus IPv4 space, it quickly turned into a meaningful business line. Public filings show that Cogent owns tens of millions of IPv4 addresses and leases a significant portion of them to other networks. In recent years, Cogent has consistently reported growing demand for IPv4 leases, with millions of addresses under contract and a recurring revenue stream that now appears regularly in its quarterly results.

Fast forward to mid-2025, and the number keeps climbing – in Q2 2025, Cogent reported $15.3 million from IPv4 leasing in a single quarter, with Q3 figures rising even further.

Analysts generally value Cogent's IPv4 portfolio in the hundreds of millions of dollars at today's market prices - a tempting prospect for any CFO considering a sale. But Cogent has chosen the long game: keeping ownership while collecting predictable, recurring revenue.

And that's exactly the dilemma many address holders face in the sell-vs-lease IPv4 debate. Prices for large blocks have softened – some dropping below $20 per IP – while leasing platforms continue to show stable demand around $0.40 per IP per month. The question is no longer simple:

Should you sell your IPs and free up capital, or lease them out and earn consistent returns?

That's where break-even math comes in.

In this post, we'll dig into the real economics behind the sell-or-lease decision. With updated 2025 market data and live platform benchmarks, we'll look at payback timelines, occupancy sensitivity, and the scenarios where leasing IPv4 space truly pays off – and when selling still makes more sense.

The 2025 IPv4 Market Overview

Let's begin by taking a high-level view of where the IPv4 marketplace stands in 2025 – so you understand the backdrop behind any decision to sell IP addresses or lease IP addresses.

Lease price & utilization benchmarks

On the leasing side, platforms such as IPXO show that the average monthly lease rate across all blocks and regions over the past 90 days is about US $0.41 per IP/month, with utilization running at roughly 80%.

In other words, demand remains strong, and pricing is reasonably stable. Lease rates have ticked down slightly since their 2024 highs, but utilization has held steady – suggesting that customers are still willing to pay, though they're seeking better value for money.

Sale price dispersion by block size

On the sale side, however, volatility has returned. According to industry reports, in June 2025 the average price for a /16 block fell below US $20 per IP for the first time since 2019. Smaller blocks (for example, /20 to /24) have proved more resilient, but large blocks are clearly facing downward pressure.

This divergence is key: large holders are contending with weaker pricing and slower sales cycles, while smaller allocations continue to find buyers more easily.

Leasing offers more dependable, recurring cash flow and stable pricing, while selling – especially large blocks – involves greater timing uncertainty and more variable value. Your optimal strategy depends on block size, region, utilization level, and whether you prefer steady revenue or a one-time capital gain.

Sell or Lease IPv4 Addresses: The Cashflow Equation

If you own IPv4 addresses, you're sitting on a digital asset that keeps generating value. The big question is how to capture it: should you sell your IPs now for a lump sum, or lease them out to earn a steady stream of monthly income? To make that choice, let's break down what you actually control – and how those choices shape your returns.

The Levers You Control

When you lease instead of sell, your outcome depends on a few variables you can directly influence:

Leasing rate (L): the monthly price per IP you set or negotiate.

Utilization (u): the percentage of your IPs actually leased at any time (typically 50–90%).

Fees (f): the platform's share – in IPbnb's case, the owner commission varies between 12% and 17%, based on turnover and contract conditions.

Operating costs (c): small but real – things like abuse cleanup, routing checks, or admin overhead.

Holding horizon (T): how long you plan to hold before selling (if ever).

Resale value (Pₜ): what you expect to sell the block for later.

Together, these act like dials on a dashboard. Adjust them, and you'll see how fast leasing catches up with selling.

Turning the Math Into a Picture

Think of it like this:

Selling is like taking a one-time payout today.

Leasing is like buying a rental property – you earn rent (lease income) every month and can still sell the asset later.

Mathematically, it looks like this:

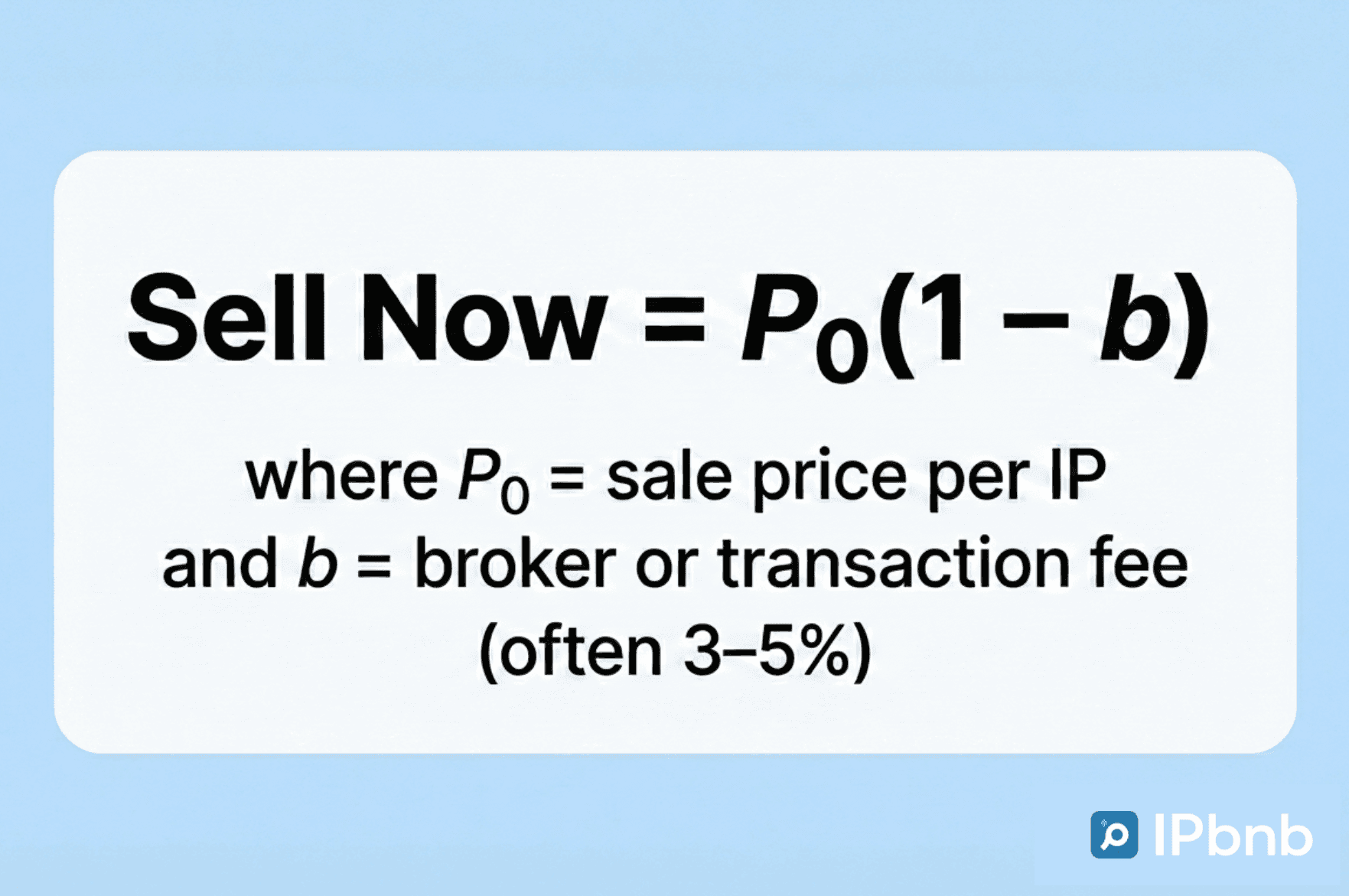

Sell now (per IP):

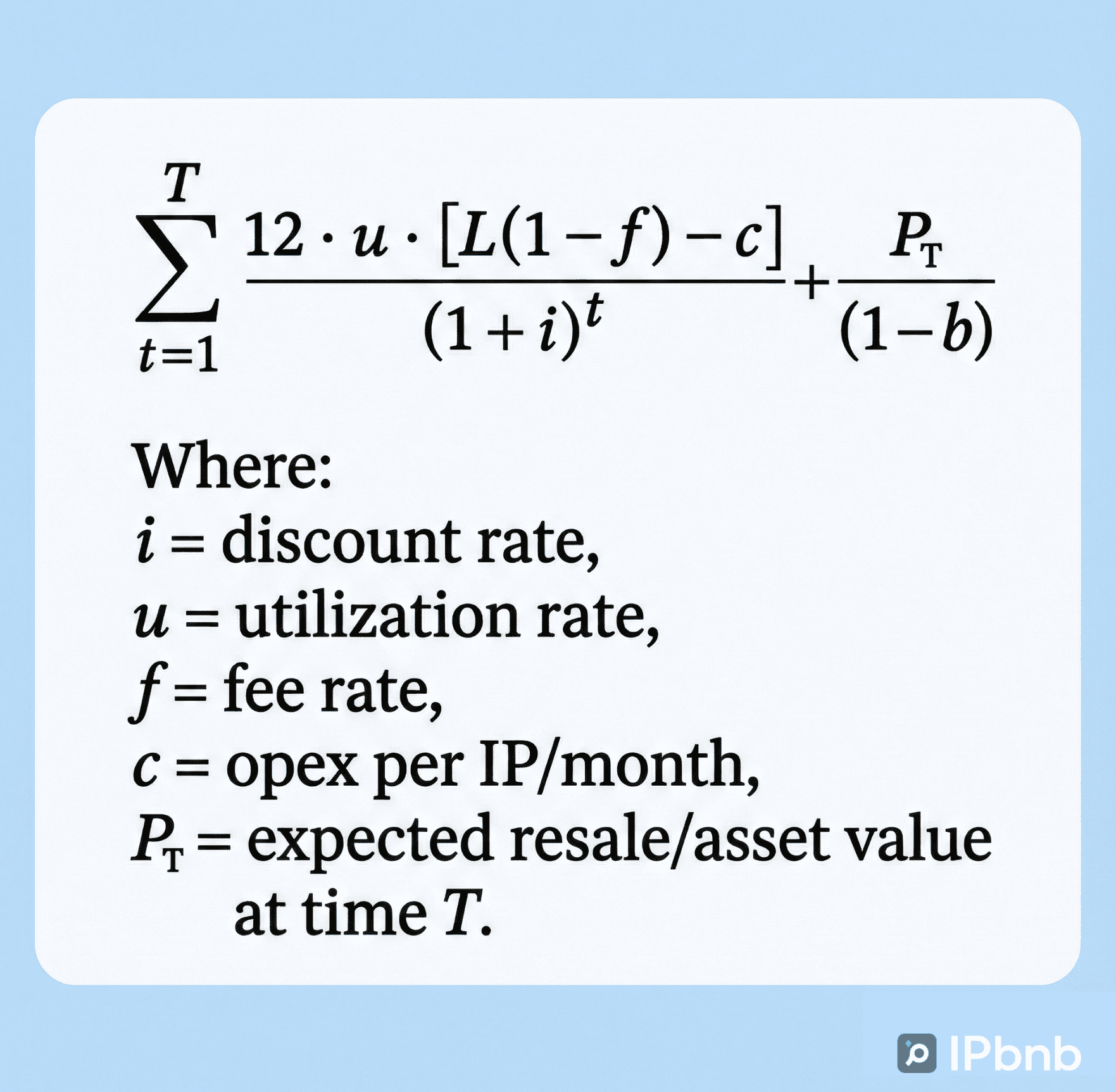

Lease, then sell later (per IP):

Here's what that means in plain English:

Every month, you collect lease income (adjusted for utilization, fees, and costs). Then you discount those future payments – just like you would for a bond – and finally add what you'll get from selling the IPs later.

Your break-even point is the year when this total equals what you would've earned from selling upfront.

Heatmap: How Occupancy and Rate Affect the "Years to Beat Selling"

Picture a heatmap where:

Y-axis: Occupancy (from 50% to 90%)

X-axis: Monthly lease rate (e.g., $0.30, $0.35, $0.40, $0.45 per IP)

A few simplified, no-discounting examples:

At 50% occupancy and $0.30/IP, the payback period is over 10 years.

At 80% occupancy and $0.40/IP, payback drops to about 5.5 years.

At 90% occupancy and $0.45/IP, the period shortens further to around 4.8 years.

These estimates highlight how sensitive the economics are to both utilization and rate. Even small decreases in occupancy or pricing can significantly extend the time required for leasing to outperform selling.

Policy Timing & Liquidity (Regional Differences)

Policy restrictions and liquidity timelines vary across RIRs (Regional Internet Registries), which can strongly influence whether selling or leasing is more practical in the short term.

RIPE NCC (Europe): A 24-month transfer restriction after address allocation.

ARIN (North America): The source organization must not have received a transfer in the prior 12 months.

APNIC (Asia Pacific): Some ranges, such as the 103/8 pool, require a five-year holding period before transfer.

LACNIC (Latin America): Typically enforces about 12 months between transfers.

These policies limit how quickly you can monetize via sale, which makes leasing a more flexible and liquid option in several regions.

When IPv4 Leasing Outperforms Selling

Leasing IPv4 isn't just a temporary fix – it can be a smarter, faster, and more flexible financial move in many real-world situations. Below are the most common cases where leasing wins, backed by 2025 market data and verified sources.

Factor | Leasing IPv4 | Selling IPv4 | Key Insight (2025) |

|---|---|---|---|

Typical rate/price | $0.40–$0.50 per IP/month | $18–$25 per IP for /16 blocks | Lease prices stable; sale prices declined ~40–50% YoY |

Revenue structure | Recurring monthly income | One-time payout | Leasing provides steady OPEX revenue; selling offers instant liquidity |

Ownership | Retained | Transferred permanently | Leasing keeps long-term optionality; selling ends ownership |

Flexibility/liquidity | High – scale up/down fast | Low – transfers locked 12–24 months | Leasing avoids RIR hold-ups |

Operational risk | Requires tenant vetting, abuse control, KYC | Minimal after sale | IPbnb pre-screens all renters & monitors reputation 24/7 |

Cash-flow profile | Predictable monthly OPEX | Large one-off CAPEX inflow | Leasing smooths income; selling boosts short-term liquidity |

Best for… | Short/uncertain horizon, startups, pilots, M&A transitions | Owners exiting IPv4 market or needing immediate capital | Leasing suits 1–5 yr plans; selling fits full divestment |

Short-Term or Uncertain Needs

If you're unsure whether you'll need the block for more than three to four years, leasing often makes more sense than buying.

Recent data from IPXO and other platforms show average lease rates around $0.40–$0.50 per IP per month, depending on block size and reputation. Meanwhile, the purchase market has turned volatile – large /16 blocks dropped below $20/IP in mid-2025, down from around $45–$50/IP just a year earlier.

Why it matters: If you buy and then sell into a downswing, your IRR (internal rate of return) drops sharply. By choosing to lease IP addresses, you match your spending to usage and avoid the risk of mistiming the resale market.

Fast Scaling and Flexibility

Leasing lets you scale up or down – and even distribute across regions – within weeks, while regional registry (RIR) transfer rules can delay ownership transfers for months or even years. These rules can limit liquidity for owners.

Platforms like IPbnb simplify the process by acting as a trusted mediator between IPv4 owners and tenants, handling screening, routing authorization, abuse monitoring, and reputation management. That means less paperwork, faster onboarding, and a safer way to lease IPv4 space at scale.

With professional IP leasing services like this, you can expand, relocate, or exit projects without waiting periods or complex policy approvals.

Cloud Deployments and Cost Control

Since February 1, 2024, Amazon Web Services charges $0.005 per public IPv4 per hour (~$43/year) – but BYOIP (Bring Your Own IP) is exempt from that specific fee.

Leasing provides clean, routable space that can be brought to the cloud under BYOIP, cutting costs while freeing up capital. Case studies from providers like Prefixx show potential savings of several thousand dollars per year for cloud-heavy workloads, depending on configuration and scale.

OPEX Instead of CAPEX

Buying medium or large IPv4 blocks remains a capital-heavy investment, often running into hundreds of thousands or even millions of dollars. Leasing, on the other hand, turns that into a predictable monthly operating expense (OPEX) – ideal for managing cash flow and budgeting.

For startups, seasonal businesses, pilot programs, or M&A transitions, leasing provides the flexibility to move quickly without locking funds into long-term assets. It also fits naturally into modern IP address management strategies built around efficiency and adaptability.

Testing, Scaling, and Exiting Smoothly

Leasing gives teams the freedom to experiment – test new regions, launch campaigns, or run pilots – and then exit cleanly when the project wraps up. No resale headaches, no asset depreciation.

Market analyses from CircleID and IPXO show that lease prices have remained relatively stable, while sale prices swing more sharply by block size and region. Leasing protects you from that volatility and helps you plan with confidence.

Hidden Risks in the Sell vs Lease IPv4 Decision

When you're running the numbers on whether to sell or lease IPv4 addresses, don't overlook the operational and policy risks that can quietly erode your returns. The math might look clean on paper, but real-world execution often introduces hidden costs and delays.

Reputation, Abuse, and KYC Challenges

Leasing means you'll occasionally change tenants – and every new renter brings potential exposure to abuse or blacklisting incidents. Even a small number of problematic users can affect your block's reputation and future earning potential.

Platforms like IPXO report that about 97–98% of abuse cases are handled automatically, but proactive monitoring, post-lease cleanup, and Know-Your-Customer (KYC) verification still require time and attention. If you lease regularly, it's smart to budget a small "reputation buffer" to cover cleanup and downtime between tenants.

Meanwhile, IPbnb goes a step further – it checks every IP block and screens each renter before approval, ensuring full compliance and traceability. The platform also monitors reputation and routing in real time, guaranteeing that your leased IP address stays clean throughout the contract term. This extra layer of due diligence helps owners earn passive income with confidence, without worrying about blacklisting or misuse.

Fee Transparency and Cost Layers

The sell vs lease IPv4 equation can shift depending on how fees are structured.

Typical costs include:

Platform fees: around 15% on most marketplaces.

Broker or escrow fees: when you sell IPv4 addresses directly.

Transfer or policy fees: charged by regional internet registries (RIRs).

Administrative overhead: setting up contracts, verifying tenants, and managing reputation.

While these fees are manageable, ignoring them can distort your ROI model – especially for smaller blocks.

That's why platforms like IPbnb prioritize full financial transparency for both IPv4 owners and renters. All commissions, platform fees, and payout terms are clearly stated upfront, so you always know what portion of the revenue you keep and what goes toward service costs. This clarity helps owners plan realistic ROI expectations and gives renters confidence that they're working within a fair, predictable financial framework.

Policy Lock-Ups and Timing Delays

Every region has its own transfer timeline, which becomes important if you plan to sell IP addresses after leasing them. For example, RIPE NCC, which covers Europe, requires a 24-month holding period before resale.

If your strategy involves leasing first and selling later, these restrictions can extend your expected horizon. Make sure to factor these timing rules into your model before deciding how to monetize your IPv4 assets.

Leasing can offer predictable income, and selling can unlock fast liquidity – but each path comes with its own operational and compliance "gotchas."

Understanding the sell vs lease IPv4 trade-offs in context – fees, policy rules, and reputation management – helps you make a decision that maximizes value and minimizes unpleasant surprises.

Wrapping It Up

When it comes to leasing vs selling IPv4 addresses, the right move depends on your goals and time horizon – but in the 2025 marketplace, leasing is often the more advantageous option in many common cases.

Selling produces an immediate cash payout, but it's a one-time event that gives up any future upside (if demand or prices recover). Furthermore, with sale prices for large blocks declining in mid-2025 (e.g., /16s under $20/IP), selling during a soft market may limit your long-term return.

Leasing, by contrast, transforms otherwise idle addresses into a predictable monthly income stream — while you retain ownership, maintain optionality, and benefit from recurring revenue, provided your blocks remain clean and in demand. Many leasing platforms also handle routing, screening and reputation oversight, simplifying execution.

In short:

Sell if you want quick liquidity or plan to exit the IPv4 market entirely.

Lease if you prefer ongoing income, asset retention, and the flexibility to re-enter or reposition later.

For many owners in today's volatile market – especially those with short/uncertain timeframes or who prioritise agility over long-term ownership – leasing beats selling: it affords more control, more flexibility and more predictable returns while IPv4 remains scarce and strategically valuable.

Artem Kohanevich

,

Co-Founder & CEO at IPbnb

Artem is a serial entrepreneur who scaled GigaCloud into Ukraine's leading IaaS provider. Now building IPbnb - a global platform for secure IPv4 rent, sale, and management.