Build an IPv4 Portfolio with Predictable Monthly Income

We source IPv4 blocks, verify ownership, place tenants, and keep ranges clean – so you earn without operational drag.

Build an IPv4 Portfolio with Predictable Monthly Income

We source IPv4 blocks, verify ownership, place tenants, and keep ranges clean – so you earn without operational drag.

Build an IPv4 Portfolio with Predictable Monthly Income

We source IPv4 blocks, verify ownership, place tenants, and keep ranges clean – so you earn without operational drag.

Build an IPv4 Portfolio with Predictable Monthly Income

We source IPv4 blocks, verify ownership, place tenants, and keep ranges clean – so you earn without operational drag.

Why IPv4 Is an Investable Digital Asset

IPv4 is finite, but businesses still need public IPs for hosting, ISPs, data centers, security services, and cloud migrations. The investment thesis is simple: buy supply, lease for recurring revenue, keep reputation clean, exit via resale.

Recurring revenue

Leases create predictable monthly cash flow while the asset remains in your ownership.

Operational moat

Reputation, routing readiness, and tenant quality drive utilization and pricing – the platform manages the operational risk.

Multiple exits

Keep leasing for cash flow, rebalance your portfolio, or sell blocks when the market is favorable.

Why IPv4 Is an Investable Digital Asset

IPv4 is finite, but businesses still need public IPs for hosting, ISPs, data centers, security services, and cloud migrations. The investment thesis is simple: buy supply, lease for recurring revenue, keep reputation clean, exit via resale.

Recurring revenue

Leases create predictable monthly cash flow while the asset remains in your ownership.

Operational moat

Reputation, routing readiness, and tenant quality drive utilization and pricing – the platform manages the operational risk.

Multiple exits

Keep leasing for cash flow, rebalance your portfolio, or sell blocks when the market is favorable.

Why IPv4 Is an Investable Digital Asset

IPv4 is finite, but businesses still need public IPs for hosting, ISPs, data centers, security services, and cloud migrations. The investment thesis is simple: buy supply, lease for recurring revenue, keep reputation clean, exit via resale.

Recurring revenue

Leases create predictable monthly cash flow while the asset remains in your ownership.

Operational moat

Reputation, routing readiness, and tenant quality drive utilization and pricing – the platform manages the operational risk.

Multiple exits

Keep leasing for cash flow, rebalance your portfolio, or sell blocks when the market is favorable.

Why IPv4 Is an Investable Digital Asset

IPv4 is finite, but businesses still need public IPs for hosting, ISPs, data centers, security services, and cloud migrations. The investment thesis is simple: buy supply, lease for recurring revenue, keep reputation clean, exit via resale.

Recurring revenue

Leases create predictable monthly cash flow while the asset remains in your ownership.

Operational moat

Reputation, routing readiness, and tenant quality drive utilization and pricing – the platform manages the operational risk.

Multiple exits

Keep leasing for cash flow, rebalance your portfolio, or sell blocks when the market is favorable.

How IPv4 Investing Works

Step 1

Source the right block

We help identify blocks that match your target size, RIR region, and strategy.

Step 2

Due diligence and transfer

Ownership checks, reputation screening, and transfer coordination so title is clean.

Step 3

Put it to work

We place verified tenants and run the leasing ops so ranges stay usable.

Step 4

Portfolio reporting and resale

Real-time portfolio view, revenue history, and support when you decide to sell.

How IPv4 Investing Works

Step 1

Source the right block

We help identify blocks that match your target size, RIR region, and strategy.

Step 2

Due diligence and transfer

Ownership checks, reputation screening, and transfer coordination so title is clean.

Step 3

Put it to work

We place verified tenants and run the leasing ops so ranges stay usable.

Step 4

Portfolio reporting and resale

Real-time portfolio view, revenue history, and support when you decide to sell.

How IPv4 Investing Works

Step 1

Source the right block

We help identify blocks that match your target size, RIR region, and strategy.

Step 2

Due diligence and transfer

Ownership checks, reputation screening, and transfer coordination so title is clean.

Step 3

Put it to work

We place verified tenants and run the leasing ops so ranges stay usable.

Step 4

Portfolio reporting and resale

Real-time portfolio view, revenue history, and support when you decide to sell.

How IPv4 Investing Works

Step 1

Source the right block

We help identify blocks that match your target size, RIR region, and strategy.

Step 2

Due diligence and transfer

Ownership checks, reputation screening, and transfer coordination so title is clean.

Step 3

Put it to work

We place verified tenants and run the leasing ops so ranges stay usable.

Step 4

Portfolio reporting and resale

Real-time portfolio view, revenue history, and support when you decide to sell.

Built for Portfolio-Style IPv4 Investing

Designed for transparency: clear workflows, auditable actions, and measurable outcomes.

Deal Sourcing

We identify IPv4 blocks that fit your strategy by size, region, and liquidity.

Due Diligence

Ownership verification plus reputation checks before you commit capital.

Acquisition & Transfer Support

We coordinate the transfer workflow and paperwork to help ensure clean title.

Managed Leasing

We place verified tenants and handle ongoing lease operations for recurring revenue.

Reputation Monitoring

Continuous checks and early alerts to keep IPv4 ranges clean and usable.

Abuse Handling & Remediation

Centralized intake with time-bound response paths to reduce reputational damage.

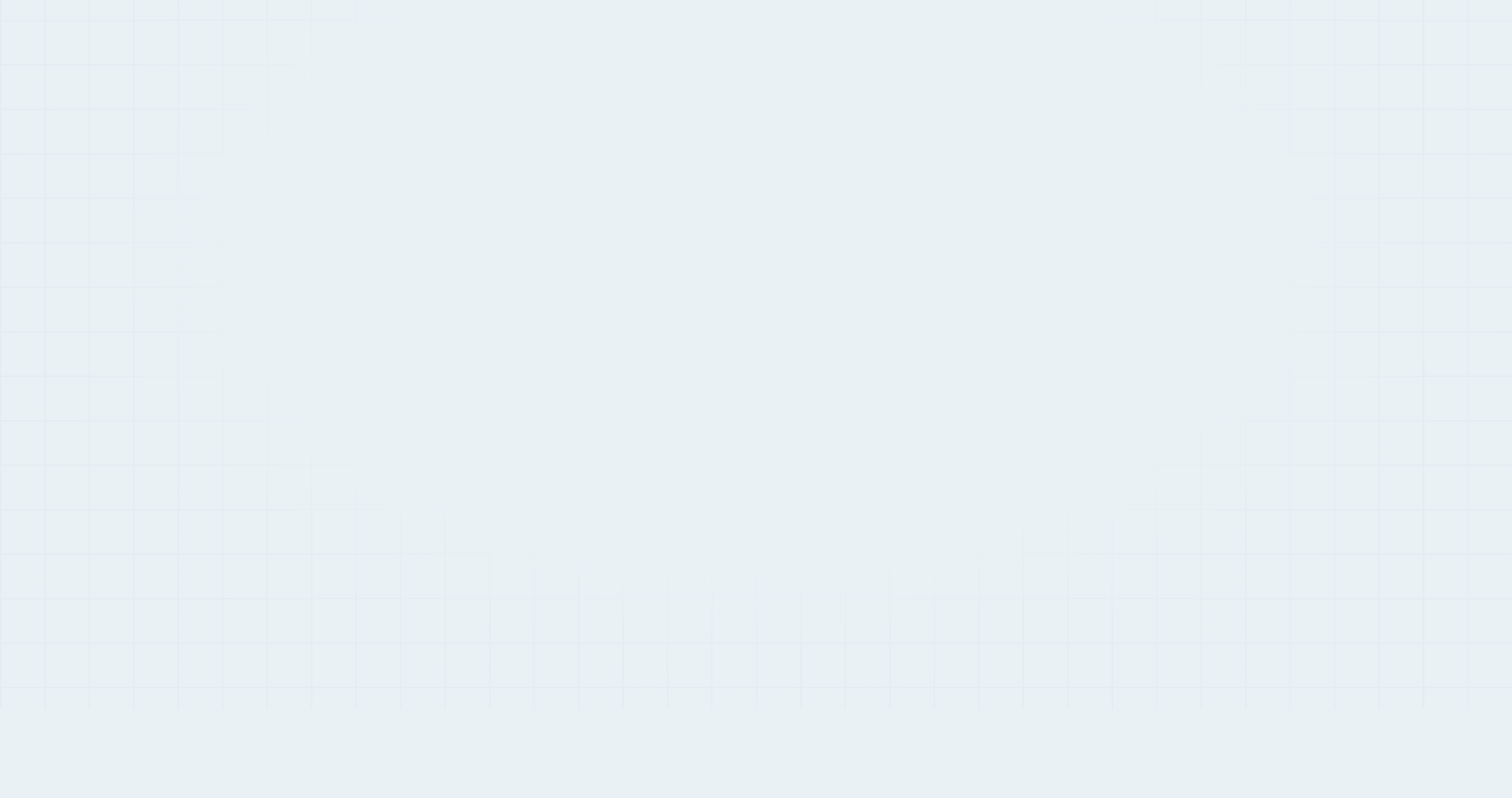

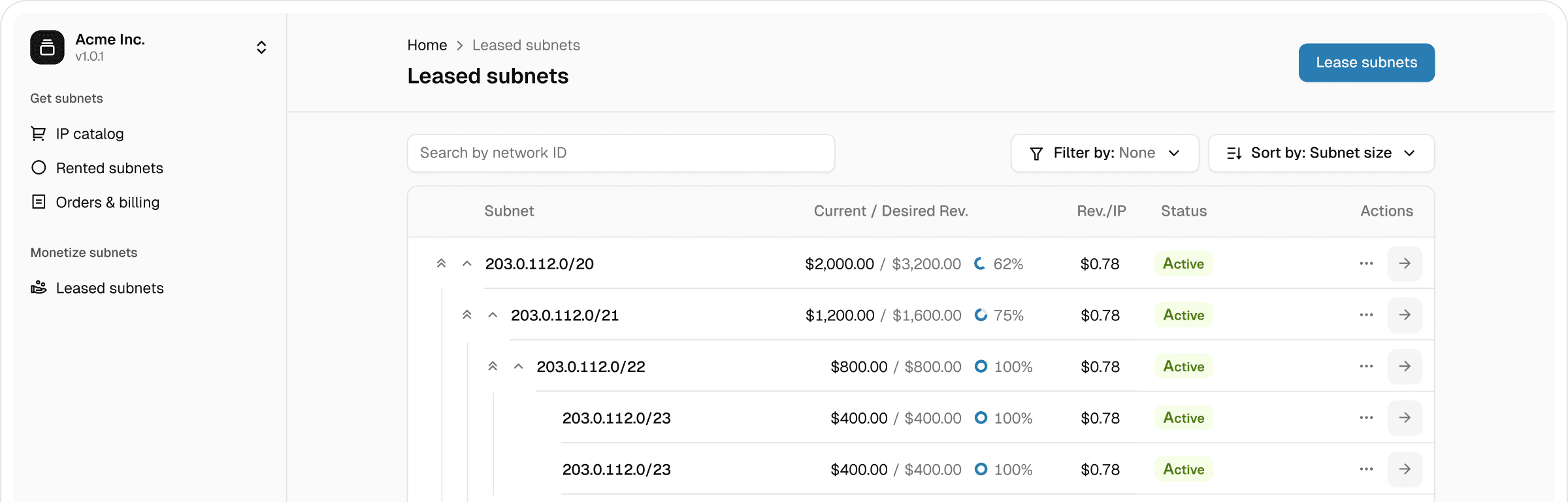

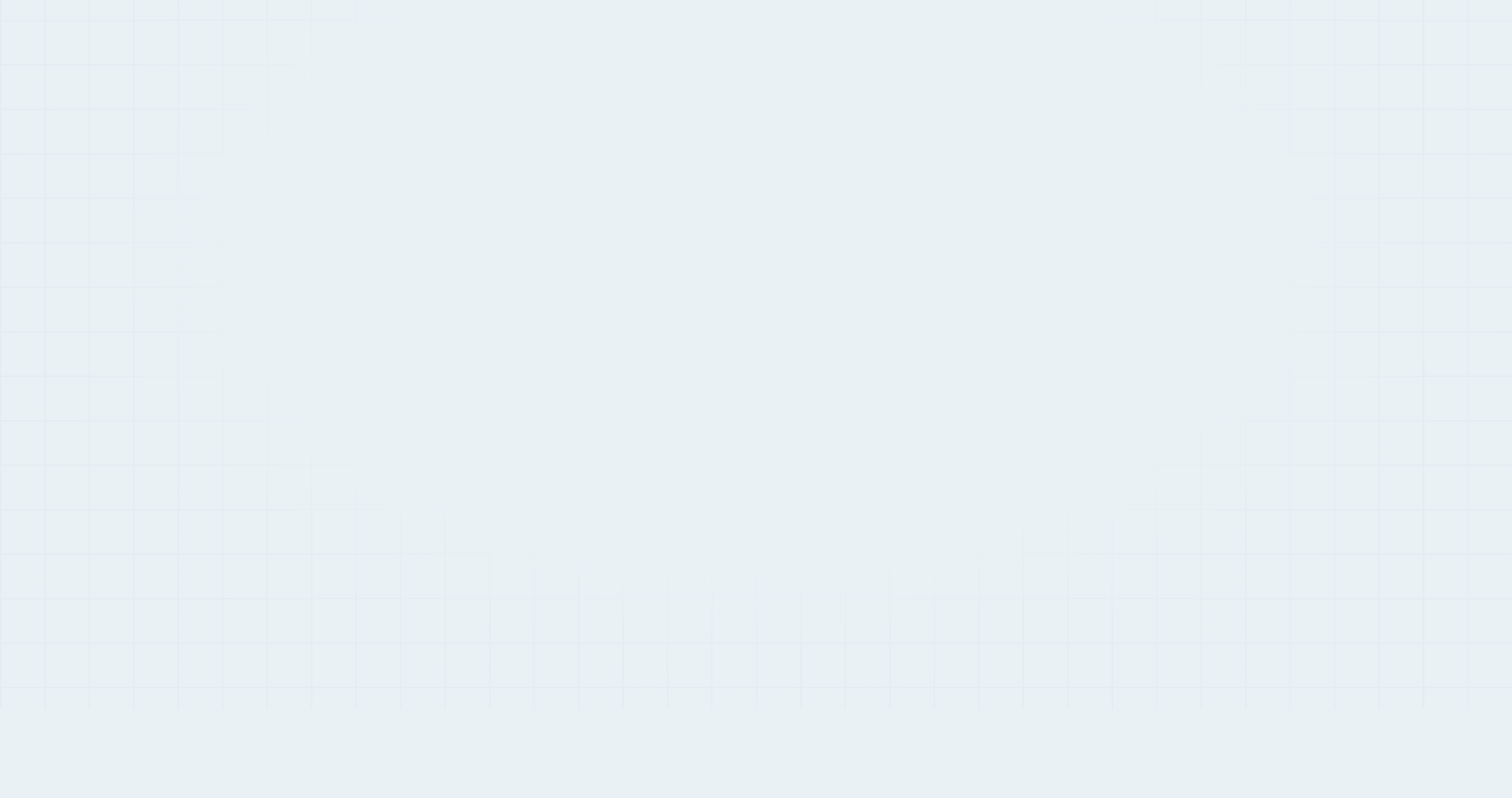

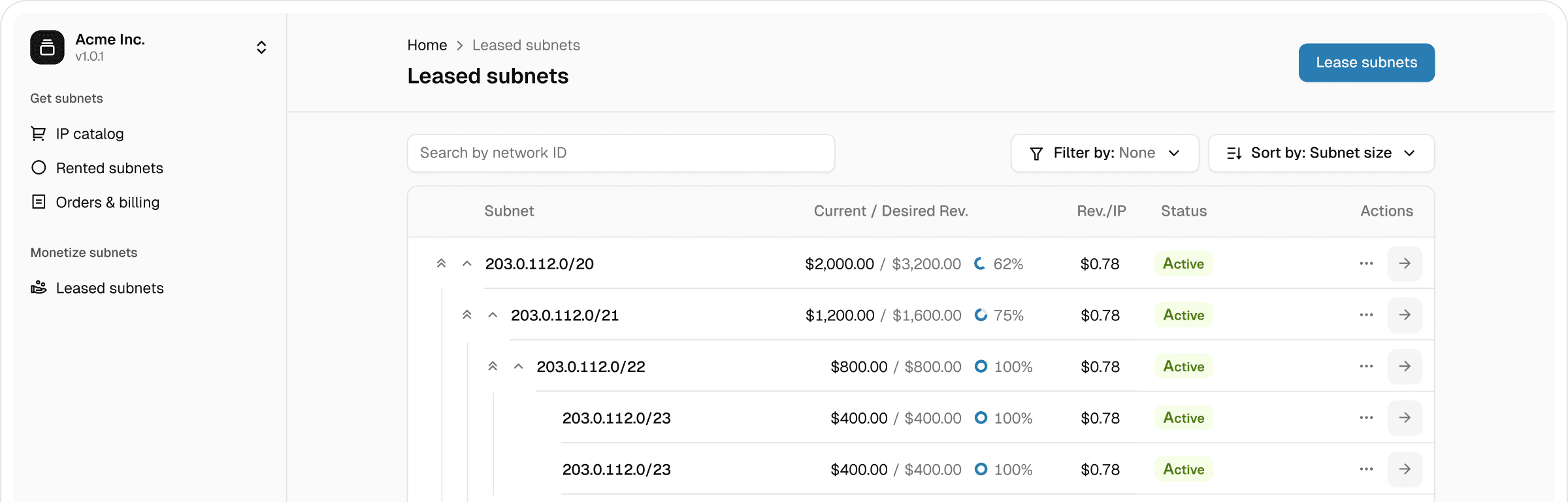

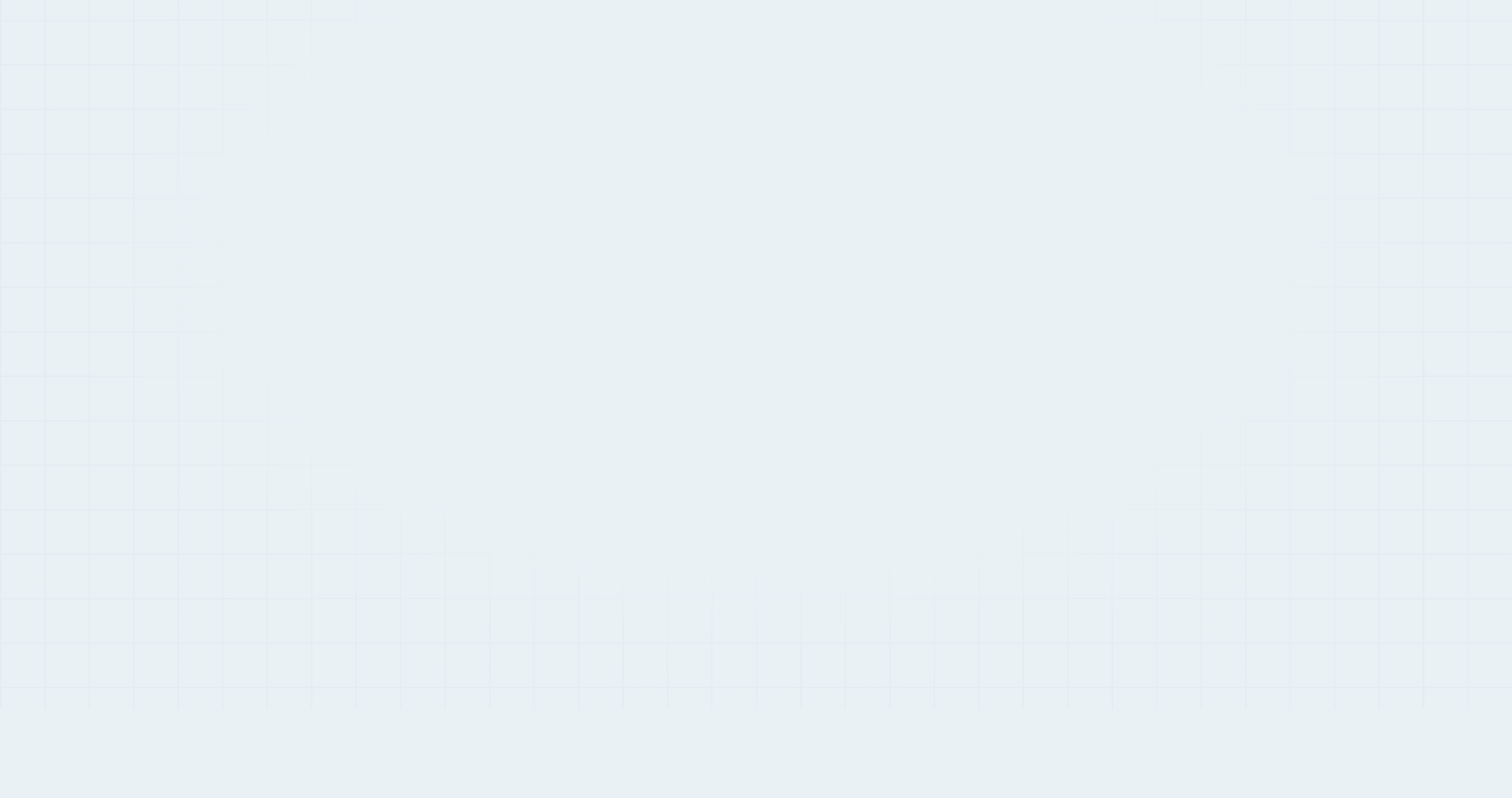

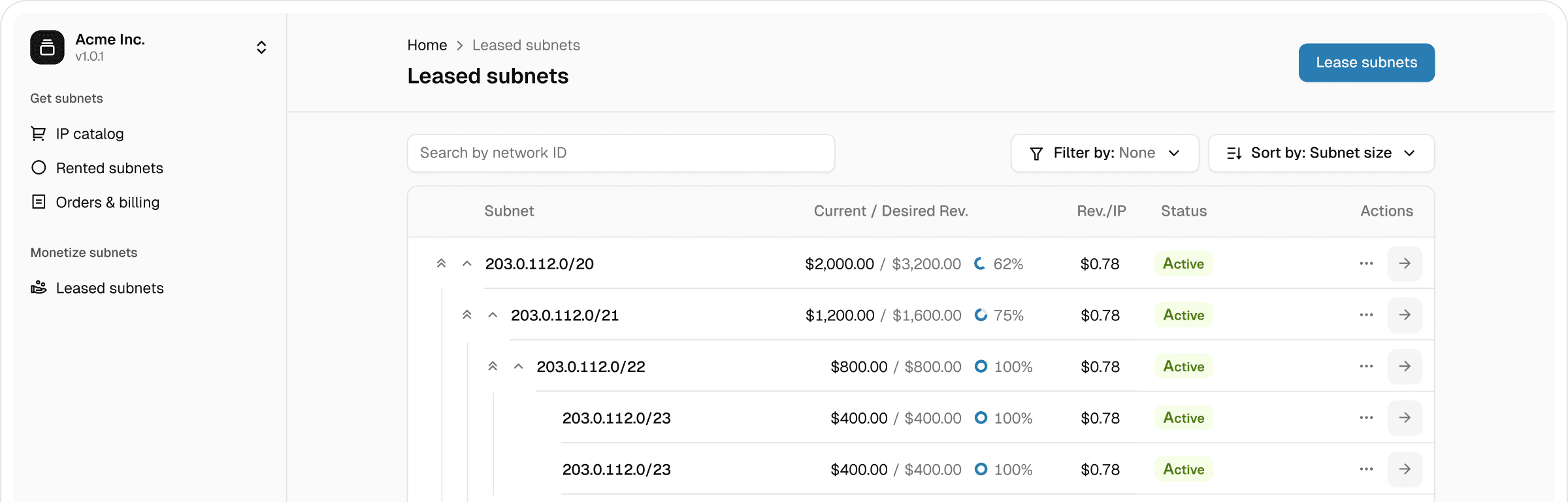

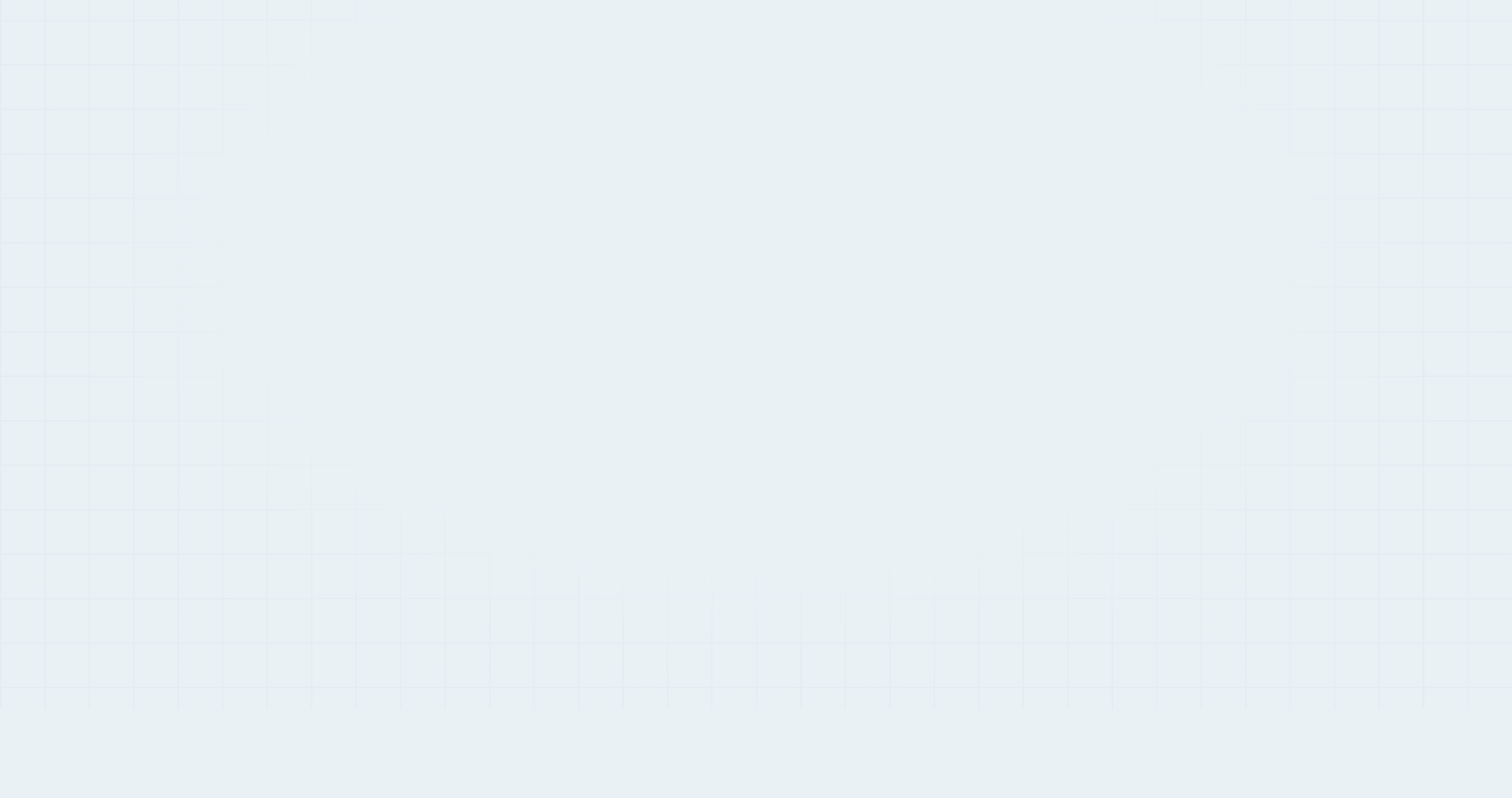

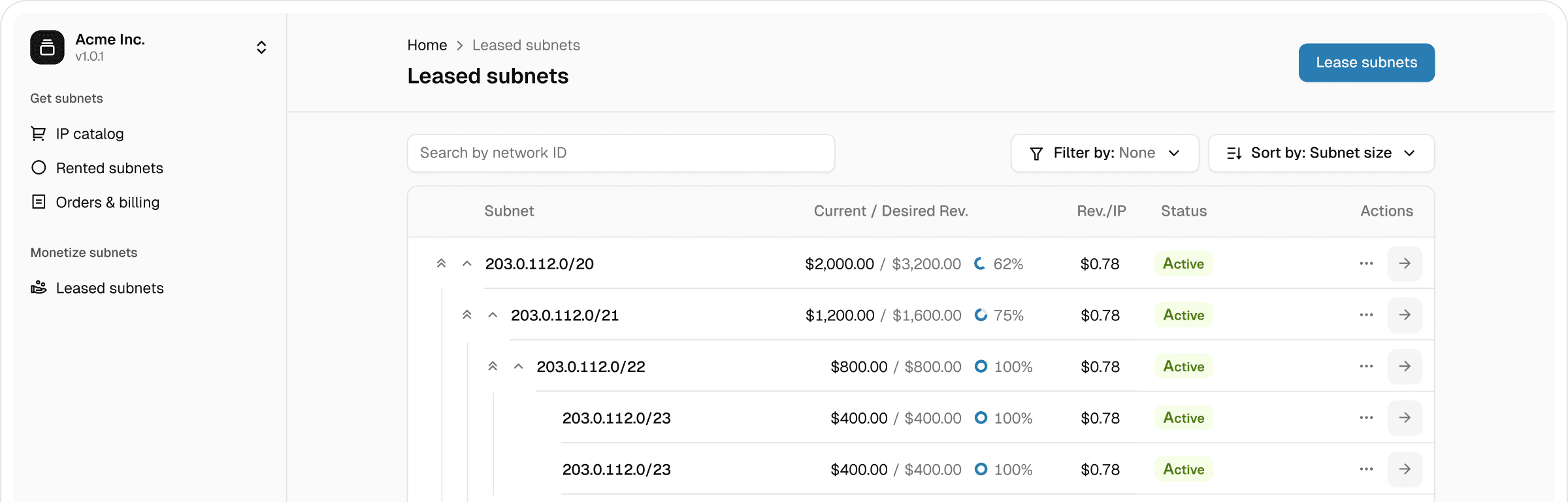

Portfolio Reporting

Track occupancy, revenue, and performance per block in one dashboard.

Exit Support

When you’re ready to sell, we support brokerage access and transfer coordination.

Built for Portfolio-Style IPv4 Investing

Designed for transparency: clear workflows, auditable actions, and measurable outcomes.

Deal Sourcing

We identify IPv4 blocks that fit your strategy by size, region, and liquidity.

Due Diligence

Ownership verification plus reputation checks before you commit capital.

Acquisition & Transfer Support

We coordinate the transfer workflow and paperwork to help ensure clean title.

Managed Leasing

We place verified tenants and handle ongoing lease operations for recurring revenue.

Reputation Monitoring

Continuous checks and early alerts to keep IPv4 ranges clean and usable.

Abuse Handling & Remediation

Centralized intake with time-bound response paths to reduce reputational damage.

Portfolio Reporting

Track occupancy, revenue, and performance per block in one dashboard.

Exit Support

When you’re ready to sell, we support brokerage access and transfer coordination.

Built for Portfolio-Style IPv4 Investing

Designed for transparency: clear workflows, auditable actions, and measurable outcomes.

Deal Sourcing

We identify IPv4 blocks that fit your strategy by size, region, and liquidity.

Due Diligence

Ownership verification plus reputation checks before you commit capital.

Acquisition & Transfer Support

We coordinate the transfer workflow and paperwork to help ensure clean title.

Managed Leasing

We place verified tenants and handle ongoing lease operations for recurring revenue.

Reputation Monitoring

Continuous checks and early alerts to keep IPv4 ranges clean and usable.

Abuse Handling & Remediation

Centralized intake with time-bound response paths to reduce reputational damage.

Portfolio Reporting

Track occupancy, revenue, and performance per block in one dashboard.

Exit Support

When you’re ready to sell, we support brokerage access and transfer coordination.

Built for Portfolio-Style IPv4 Investing

Designed for transparency: clear workflows, auditable actions, and measurable outcomes.

Deal Sourcing

We identify IPv4 blocks that fit your strategy by size, region, and liquidity.

Due Diligence

Ownership verification plus reputation checks before you commit capital.

Acquisition & Transfer Support

We coordinate the transfer workflow and paperwork to help ensure clean title.

Managed Leasing

We place verified tenants and handle ongoing lease operations for recurring revenue.

Reputation Monitoring

Continuous checks and early alerts to keep IPv4 ranges clean and usable.

Abuse Handling & Remediation

Centralized intake with time-bound response paths to reduce reputational damage.

Portfolio Reporting

Track occupancy, revenue, and performance per block in one dashboard.

Exit Support

When you’re ready to sell, we support brokerage access and transfer coordination.

Lease income drivers

Lease income is driven by block size (typically /24 and larger), range reputation, RIR region, geolocation fit, and term length. Operational factors matter too: how quickly a block can be routed, and how strict the usage profile must be. IPbnb prices to market and focuses on healthy occupancy while protecting long-term range value.

Resale price variability

Resale pricing can fluctuate with supply/demand, buyer appetite, and transfer friction by region. A clean, well-managed range typically has an easier path to exit than a “problem” range. Many investors use leasing to smooth cash flow while waiting for the right resale window.

Liquidity and timelines

Liquidity depends on documentation readiness, transfer requirements, and buyer timing. The fastest exits usually happen when ownership, routing history, and reputation are easy to verify. We help keep blocks exit-ready with clear records and coordinated transfer workflows.

Asset protection controls

IPbnb reduces downside through participant screening, clear policy enforcement, reputation monitoring, and time-bound abuse remediation. Routing guidance helps keep announcements stable and accepted by upstreams. The goal is simple: protect the range while it earns.

Returns & Risk: What to Expect

Clear expectations for monthly income, market moves, and liquidity – with controls built into the platform.

Lease income drivers

Lease income is driven by block size (typically /24 and larger), range reputation, RIR region, geolocation fit, and term length. Operational factors matter too: how quickly a block can be routed, and how strict the usage profile must be. IPbnb prices to market and focuses on healthy occupancy while protecting long-term range value.

Resale price variability

Resale pricing can fluctuate with supply/demand, buyer appetite, and transfer friction by region. A clean, well-managed range typically has an easier path to exit than a “problem” range. Many investors use leasing to smooth cash flow while waiting for the right resale window.

Liquidity and timelines

Liquidity depends on documentation readiness, transfer requirements, and buyer timing. The fastest exits usually happen when ownership, routing history, and reputation are easy to verify. We help keep blocks exit-ready with clear records and coordinated transfer workflows.

Asset protection controls

IPbnb reduces downside through participant screening, clear policy enforcement, reputation monitoring, and time-bound abuse remediation. Routing guidance helps keep announcements stable and accepted by upstreams. The goal is simple: protect the range while it earns.

Returns & Risk: What to Expect

Clear expectations for monthly income, market moves, and liquidity – with controls built into the platform.

Lease income drivers

Lease income is driven by block size (typically /24 and larger), range reputation, RIR region, geolocation fit, and term length. Operational factors matter too: how quickly a block can be routed, and how strict the usage profile must be. IPbnb prices to market and focuses on healthy occupancy while protecting long-term range value.

Resale price variability

Resale pricing can fluctuate with supply/demand, buyer appetite, and transfer friction by region. A clean, well-managed range typically has an easier path to exit than a “problem” range. Many investors use leasing to smooth cash flow while waiting for the right resale window.

Liquidity and timelines

Liquidity depends on documentation readiness, transfer requirements, and buyer timing. The fastest exits usually happen when ownership, routing history, and reputation are easy to verify. We help keep blocks exit-ready with clear records and coordinated transfer workflows.

Asset protection controls

IPbnb reduces downside through participant screening, clear policy enforcement, reputation monitoring, and time-bound abuse remediation. Routing guidance helps keep announcements stable and accepted by upstreams. The goal is simple: protect the range while it earns.

Returns & Risk: What to Expect

Clear expectations for monthly income, market moves, and liquidity – with controls built into the platform.

Lease income drivers

Lease income is driven by block size (typically /24 and larger), range reputation, RIR region, geolocation fit, and term length. Operational factors matter too: how quickly a block can be routed, and how strict the usage profile must be. IPbnb prices to market and focuses on healthy occupancy while protecting long-term range value.

Resale price variability

Resale pricing can fluctuate with supply/demand, buyer appetite, and transfer friction by region. A clean, well-managed range typically has an easier path to exit than a “problem” range. Many investors use leasing to smooth cash flow while waiting for the right resale window.

Liquidity and timelines

Liquidity depends on documentation readiness, transfer requirements, and buyer timing. The fastest exits usually happen when ownership, routing history, and reputation are easy to verify. We help keep blocks exit-ready with clear records and coordinated transfer workflows.

Asset protection controls

IPbnb reduces downside through participant screening, clear policy enforcement, reputation monitoring, and time-bound abuse remediation. Routing guidance helps keep announcements stable and accepted by upstreams. The goal is simple: protect the range while it earns.

Returns & Risk: What to Expect

Clear expectations for monthly income, market moves, and liquidity – with controls built into the platform.

Compliance Built for IPv4 Investing

We screen counterparties, enforce clear usage rules, and support secure routing to keep your IPv4 clean and investable.

KYC and KYB Screening

Verify counterparties to reduce risk and protect asset reputation.

Clear Use Policy and Audit Logs

Enforceable rules prohibiting spam, phishing, malware, DDoS.

Routing Security Guidance

LOA, RPKI, and IRR support to improve route acceptance.

Abuse Workflows With SLAs

Central intake with time-bound remediation to protect ranges.

Reputation Monitoring

24/7 blacklist monitoring alerts you before issues escalate.

Compliance Built for IPv4 Investing

We screen counterparties, enforce clear usage rules, and support secure routing to keep your IPv4 clean and investable.

KYC and KYB Screening

Verify counterparties to reduce risk and protect asset reputation.

Clear Use Policy and Audit Logs

Enforceable rules prohibiting spam, phishing, malware, DDoS.

Routing Security Guidance

LOA, RPKI, and IRR support to improve route acceptance.

Abuse Workflows With SLAs

Central intake with time-bound remediation to protect ranges.

Reputation Monitoring

24/7 blacklist monitoring alerts you before issues escalate.

Compliance Built for IPv4 Investing

We screen counterparties, enforce clear usage rules, and support secure routing to keep your IPv4 clean and investable.

KYC and KYB Screening

Verify counterparties to reduce risk and protect asset reputation.

Clear Use Policy and Audit Logs

Enforceable rules prohibiting spam, phishing, malware, DDoS.

Routing Security Guidance

LOA, RPKI, and IRR support to improve route acceptance.

Abuse Workflows With SLAs

Central intake with time-bound remediation to protect ranges.

Reputation Monitoring

24/7 blacklist monitoring alerts you before issues escalate.

Compliance Built for IPv4 Investing

We screen counterparties, enforce clear usage rules, and support secure routing to keep your IPv4 clean and investable.

KYC and KYB Screening

Verify counterparties to reduce risk and protect asset reputation.

Clear Use Policy and Audit Logs

Enforceable rules prohibiting spam, phishing, malware, DDoS.

Routing Security Guidance

LOA, RPKI, and IRR support to improve route acceptance.

Abuse Workflows With SLAs

Central intake with time-bound remediation to protect ranges.

Reputation Monitoring

24/7 blacklist monitoring alerts you before issues escalate.

FAQ

What is IPv4 investing?

IPv4 investing means acquiring IPv4 address blocks (often /24 or larger) and generating returns by leasing them to verified networks, with an option to exit via resale later.

How do returns work – leasing income vs resale?

What IPv4 block sizes can I invest in?

Do I need to understand RIRs to invest (RIPE, ARIN, APNIC)?

How long does it take to acquire an IPv4 block?

What due diligence is done before I commit capital?

Who rents the IPv4 space and how are tenants screened?

Can I exit – how does resale work?

FAQ

What is IPv4 investing?

IPv4 investing means acquiring IPv4 address blocks (often /24 or larger) and generating returns by leasing them to verified networks, with an option to exit via resale later.

How do returns work – leasing income vs resale?

What IPv4 block sizes can I invest in?

Do I need to understand RIRs to invest (RIPE, ARIN, APNIC)?

How long does it take to acquire an IPv4 block?

What due diligence is done before I commit capital?

Who rents the IPv4 space and how are tenants screened?

Can I exit – how does resale work?

FAQ

What is IPv4 investing?

IPv4 investing means acquiring IPv4 address blocks (often /24 or larger) and generating returns by leasing them to verified networks, with an option to exit via resale later.

How do returns work – leasing income vs resale?

What IPv4 block sizes can I invest in?

Do I need to understand RIRs to invest (RIPE, ARIN, APNIC)?

How long does it take to acquire an IPv4 block?

What due diligence is done before I commit capital?

Who rents the IPv4 space and how are tenants screened?

Can I exit – how does resale work?

FAQ

What is IPv4 investing?

IPv4 investing means acquiring IPv4 address blocks (often /24 or larger) and generating returns by leasing them to verified networks, with an option to exit via resale later.

How do returns work – leasing income vs resale?

What IPv4 block sizes can I invest in?

Do I need to understand RIRs to invest (RIPE, ARIN, APNIC)?

How long does it take to acquire an IPv4 block?

What due diligence is done before I commit capital?

Who rents the IPv4 space and how are tenants screened?

Can I exit – how does resale work?

Build an IPv4 portfolio with predictable cash flow

We help you buy clean blocks, place verified tenants, and track performance with audit-ready reporting.

Build an IPv4 portfolio with predictable cash flow

We help you buy clean blocks, place verified tenants, and track performance with audit-ready reporting.

Build an IPv4 portfolio with predictable cash flow

We help you buy clean blocks, place verified tenants, and track performance with audit-ready reporting.

Build an IPv4 portfolio with predictable cash flow

We help you buy clean blocks, place verified tenants, and track performance with audit-ready reporting.

Why IPbnb

Why IPbnb

Why IPbnb

Why IPbnb